Assess potential investments in your scientific career

How can you assess potential investments in your scientific career like professional coaching or online courses? Such investments could catapult you forward in your career leading to huge benefits like pay raises, promotions, or more interesting projects. Or they could be a huge waste of money. To make the right decisions you need an analytical framework to assess any potential investment.

Whether you’re preparing for retirement, buying a new house, managing a Fortune 500 company, or trying to improve your career satisfaction, you can apply the same basic framework. You want to leverage your available resources to generate the maximum possible benefit. This is the definition of an investment, and the financial establishment has figured out how to do this pretty well.

Professional coaching, education, networking, or anything else you dream up could be a lucrative investment in your career. Or they could be a complete waste of your time and money. You need to do the personalized analysis to assess each investment.

This post will help you assess potential investments in your scientific career by providing a framework and calculator to choose the best investments for you.

Investment Framework

To assess potential investments in your scientific career, you need to follow three basic steps:

- Benefit: estimate the magnitude of the expected benefit and when it will be collected

- Cost: estimate the magnitude of the expected cost and when it will be collected

- Calculation: determine the attractiveness of the investment

We’ll walk through each of these steps below.

Benefits

The benefits to your scientific career resulting from an investment can be difficult to determine. Consider what you’re trying to achieve.

Benefit Scenario 1

If you’re seeking a promotion, then the immediate bump in salary is easy to calculate. Let’s say you make 100k USD per year currently and expect to make 120k USD per year after the promotion. If an investment results in that promotion, then the benefit is 20k USD, right? Wrong. Due to the time value of money, 20k USD this year is worth more than 20k USD next year. Additionally, getting promoted now might mean that your next promotion will come in 4 years instead of 5. In that case, you’ll get that promotion money sooner when it’s worth more. Finally, maybe your career investment now will speed up your promotion cycle now and in the future. Instead of just shifting your 4-year promotion cycle up one year, it could reduce your promotion cycle to 3.5 years indefinitely. This too results in you getting more money sooner.

Benefit Scenario 2

If you’re looking to make a career transition, the benefits may be less financially motivated. Maybe you’re miserable in your current role where your salary is 100k USD. You hate your current role so much that you’d be willing to stomach a 20k USD pay cut for a your dream job. Congratulations, you’ve just quantified your misery and we can use our financial framework. Imagine that an investment helps you land your dream job which pays a salary of 110k USD (you didn’t tell them you’d settle for less). Your investment produced a 30k USD benefit (10k USD in incremental salary + 20k USD in misery avoidance) in the first year alone.

Benefit Scenario 3

Perhaps you love your current role but want to future-proof yourself so that you won’t be replaced by an AI-powered robot in 10 years. Let’s model out the scenario you’re trying to avoid. For simplicity, let’s say your projected 200k USD future salary is slashed to 0 USD, and you collect 100k USD in severance and unemployment benefits. You’re unemployed for exactly one year and find a new job with the same 200k USD salary (an unlikely prospect in this version of the future). If an investment can save you from this fate, the investment’s benefit is 100k USD (200k – 100k). But remember 100k USD 10 years from now is worth significantly less today (actually, it’s worth about 46k USD today). So it would be financially rational to pay 46k USD today to avoid this future fate.

Expected Values of Benefits

The scenarios above were described as if you–as the investor–know how the future will turn out. Of course, this is isn’t the case. Because the future is uncertain, when you assess potential investments in your scientific career, you should calculate the benefits probabilistically. Specifically, we should adjust the benefit by the probability that the benefit will materialize.

For example, in Scenario 3 above, we estimated that benefit of avoiding that layoff was 46k USD. If you further estimate that there’s only a 10% chance of being replaced by that AI-powered robot scientist, then expected value of this benefit is 4,600 USD (46k * 0.1). So it would be financially rational to pay 4,600 USD today as an insurance policy against this possibility.

Costs

All investments require a cost–an expenditure of resources that could have been used for something else. When you assess potential investments in your scientific career, you should consider that the costs will often have multiple components including financial, time, comfort, personal equity, etc.

Financial and non-financial costs

Financial costs are the easiest to estimate. If an online course has a listed price of 250 USD, the financial cost is 250 USD. However, investing that 250 USD isn’t like putting it into a mutual fund. In addition to the financial component, the online course will require you to dedicate time and energy to studying. Since there are only so many hours in the day, allocating those hours to the course means you can’t devote them to exercising, spending time with your family and friends, or just relaxing. Additionally, after learning the course material, you still have to transform that knowledge into an action or result to realize a return on your investment. These non-financial costs are often neglected, in part because they’re difficult to quantify. But as we saw in the benefits section above, creatively translating these costs into monetary values is achievable and can be clarifying.

Creative cost determination

Let’s say you need to devote 10 hours of your time to transform your course investment into a return. How much are those 10 hours worth in dollars? You could calculate what you get paid per an hour perhaps dividing your 100k USD annual salary into a rate of about 50 USD per hour. If that is your rate, would you clean my house for 50 USD per hour? If not, how much would you require? Would your answer change if you were working 80 hours a week already? What would I have to pay you to forego your favorite leisure activity of the week vs working during a time you had nothing going on? How much would you pay for an extra year of life? The point is there are a variety of ways to estimate the value of your time, and the answer will change with circumstances.

Let’s assume you decide to value your precious free time at 75 USD per hour. The course will cost you 250 + 75 * 10 hours = 1,000 USD. The vast majority of the cost is non-financial! But it might still be a very good investment.

Investment Return Expectations

Any investment decision should consider not only the magnitude of the returned benefit; it should assess if it returns benefits that exceed all other available possibilities. In other words, you should invest your precious resources where the highest returns are expected. I could put all of my money in a savings account returning a few percentage points annually, at the very best of times. But I know that, over the long-term, an index fund of the S&P500 will return closer to 10% annually. After accounting for fees and inflation, this return is probably closer to 7.5%. Thus, any financial investment would need to generate a return greater than 7.5% or I shouldn’t make it.

But things aren’t always that simple. There are numerous factors that could change your personal expectations for investment returns.

Liquidity

Especially if you’re cash poor (which we all identify as), you may require a huge return to fork over your hard-earned dollars. If you’re not investing all of your disposable income in the stock market, that’s exactly what you’re saying: “I value my Starbucks and Netflix subscription more than a 7.5% return.”

Time value and horizons

If you’re on summer break from your undergraduate studies, time may be your greatest available resource. You may judge that spending those hours building experience by volunteering in a research laboratory will eventually be worth it. If so, you’re saying “Getting paid nothing this summer will eventually generate a superior return to working at McDonalds and investing my wages in an S&P500 index fund.”

Certainty and confidence

From an expected value perspective, it may make perfect sense to make an investment with a 100% return that you are 99% certain will materialize. But if that 1% chance of failure leaves you flat broke and destitute, would you make the bet? It’s okay if this makes you uncomfortable because you’re not a probability calculator–you’re a human.

Moving the needle

An investment with a 1,000% return would be amazing, but if you can only invest 1 USD, your total return is capped at 10 USD. While this is an amazing investment from a relative percentage standpoint, is it really enough to get excited about?

Because of these types of complications, you need to be flexible in your assessment. Nevertheless, a disciplined financial modeling approach is the best way to capture assumptions, quantify everything, and make the best possible decisions.

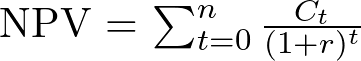

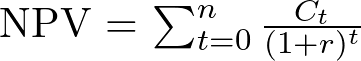

Net Present Value (NPV)

NPV is a calculation that determines how much cash an investment will generate. It takes into account the timing of investment as well as the returns. If you invest 1,000 USD today in the hypothetical online course described above (a -1,000 USD cash flow) and get 2,000 USD (a +2,000 USD cash flow) back in 5 years, you generated a 1,000 USD profit. However, what if you had invested that money somewhere else like the stock market. We discussed above that you would have expected a 7.5% annual return from the S&P500 index fund. (In financial parlance this return is called your “discount rate”.) Over 5 years, this “safe” investment would have returned 1,000*(100%+7.5%)^5 = 1,436 USD. Therefore, investing in the course generated a 564 USD profit relative to the next best alternative (2,000-1,436 USD). In other words, the NPV of this investment is 564 USD.

Any time the NPV is positive (i.e. greater than 0), you have a worthwhile investment. However, you should compare potential investments and invest your resources in those options with the highest NPV’s. That’s a personal question, but this analytical framework gives you a method to evaluate investments rigorously. There is a simple calculator at the bottom of this article you can use, and here is the formalized mathematical principle:

Internal Rate of Return (IRR)

IRR is a related financial tool that contextualizes returns in a way that many people feel is easier to interpret. The IRR is the annual return that would make the sum of both positive and negative cashflows equal to zero. You don’t need to think about what your discount rate is to calculate IRR. Instead, the calculation yields an annual return percentage that you can compare against other investments. You should choose the investments with the highest IRR. (Remember that an S&P500 index fund has an expected average annual return of around 7.5% historically.)

Calculator

Time to put these concepts into action.

Let’s say you currently make 100k USD per year as a scientist. You don’t have any immediate goal of getting a new job or transitioning careers. Instead, you just want to learn how to get ahead in a corporate environment which is new to you after your academic training. You invest 1,000 USD in professional coaching this year (perhaps with Advancing Scientists). You think it’s reasonable (as do I), that you can boost your average annual raise from 3.0% to 3.5% and your promotion cycle from 5 years to 4.5 years.

This would be an incredible investment that would make hedge fund managers envious! Over the course of your career, you would make about 750k USD more. Even accounting for the time value of money, this investment has an NPV greater than 160k USD. The IRR would be almost 98%!

Play around with the calculator below to assess potential investments in your scientific career. You need to join the Advancing Scientists newsletter to utilize this free tool. We’ll periodically send you our latest articles and updates. It’s a win-win for you!

If you have professional investments outside the limited scope of this tool, I’ll happily help you model them. Just email me at scott@advancingscientists.com.

In a final call to action, I can help you generate these incredible returns. Investing in yourself through professional coaching can be hugely beneficial. Book a heavily discounted introductory session below to find out more and get a feel for the modest prices and large returns.